If it hasn’t already, your restaurant business is about to experience an influx of diners requesting to pay with their EMV chip cards. Move over swipe and sign, it’s time to make room for EMV chip and dip!

Despite only 25% of all credit card transactions being made in the US, nearly 50% of all credit card fraud is reported within American borders. It’s EMV chip cards that are here to change the face of fraud in the USA.

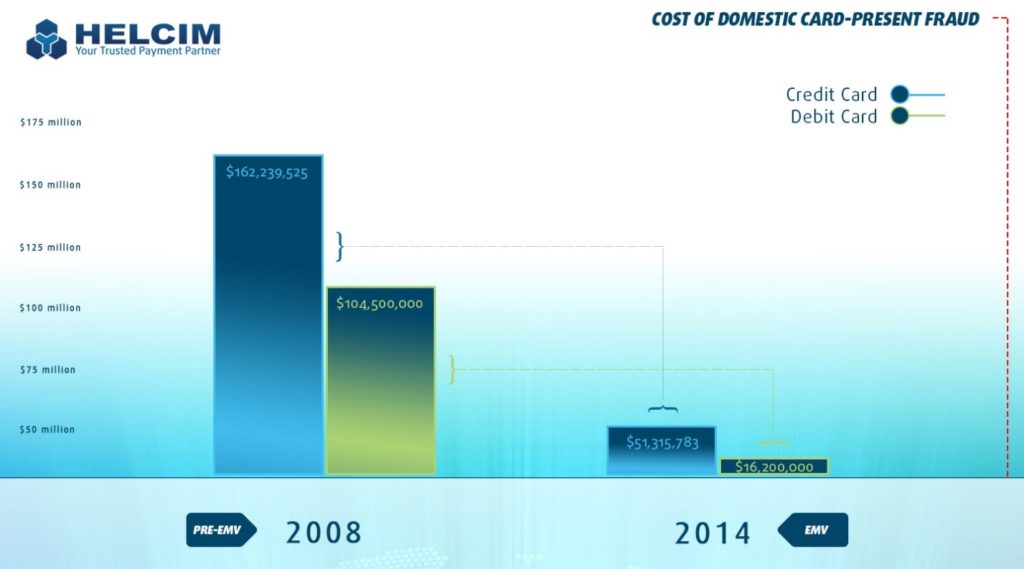

Post EMV migration, Canada, France and the UK have all seen significant decreases in card-present fraud, sometimes exceeding 50%.

The graph below demonstrates the difference over a 6-year EMV migration for Canadian businesses.

Is it mandatory for your restaurant to make the switch?

Nope!

There is no governmental legislation enforcing the transition from ‘swipe’ to ‘chip’ yet; however, credit card companies are active in holding merchants accountable for the costs associated with fraudulent card-present transactions processed on dated terminal equipment.

The US EMV migration began in October of 2015. Since, businesses around the world have been scrambling to upgrade credit card processing hardware in order to meet industry guidelines. With all the controversy, what’s in it for your restaurant business.

Save Time for the Important Tasks:

Currently your wait staff makes two authorizations, one at the time the bill is settled and another at the end of the night when the tip adjustments are consolidated. With EMV your guest is prompted to leave a tip before the transaction is authorized. This makes for a faster bill payment and table turnaround time and eliminates the need to reauthorize tip adjustments at the end of the night. Closing your terminal batch can be set up to occur automatically at the end of the night with EMV.

Reduce Human Error and Chargebacks:

With EMV enabled pay@table terminals your guest will be prompted to select one of two options during the transaction, either to ‘tip’ or ‘no tip’. If the ‘tip’ option is selected, your guest will be able to choose by percentage or by a dollar amount before authorizing the payment with their PIN. This eliminates errors in reconciling tip adjustments and wait staff fraud therefor reducing your opportunity for chargebacks later.

Fraud Reduction:

EMV payments validate the card owner by their secure PIN. By processing a chip card in your EMV enabled terminal, liabilities of fraudulent transactions shift away from your business. How much fraud? For the answers we look towards nations withy EMV migration experience. Back to Canada for another example:

Expand Payments Along With Customer Demand:

Why limit your guests to just ‘swipe and sign’ payments? New and secure payment technologies are evolving how payments are processed. Helcim’s EMV terminal options process magnetic stripe cards, EMV chip card transactions, NFC (near-field-contactless) payments, Apply Pay and other mobile wallets using NFC technologies.

The face of payments is changing and so are the needs of your customers! EMV upgrades will help keep your restaurant on top of the new trends.

Boost Diner’s Confidence in Your Restaurant:

Make payment security a priority in your restaurant with EMV enabled terminals. This reassures your guest that their card is in safe hands. By accepting your guest’s payment at their table they can keep their card insight at all times.

EMV is an investment in payment security for your restaurant and your guests. Below is a quick breakdown of how the EMV upgrade protects your customers in ways swipe cards fail to.

Call Helcim today (1-877-643-5246) and learn how your restaurant can use the EMV migration as an opportunity to jump into cost+ discounted pricing.

Visit the EMV forums on Reddit for up to date information and discussion regarding EMV chip card technologies.