Not everybody needs or can justify an expensive legacy Transportation Management Systems, (TMS Software). Let’s face it, getting a low to mid-six-figure transportation management system with its attendant recurring fees approved by management isn’t the easiest thing to do for most logistics managers. For most SMB applications, a mid-range or mid-tier logistics software platform can provide 90% of what is needed by most companies for a mere fraction of the cost.

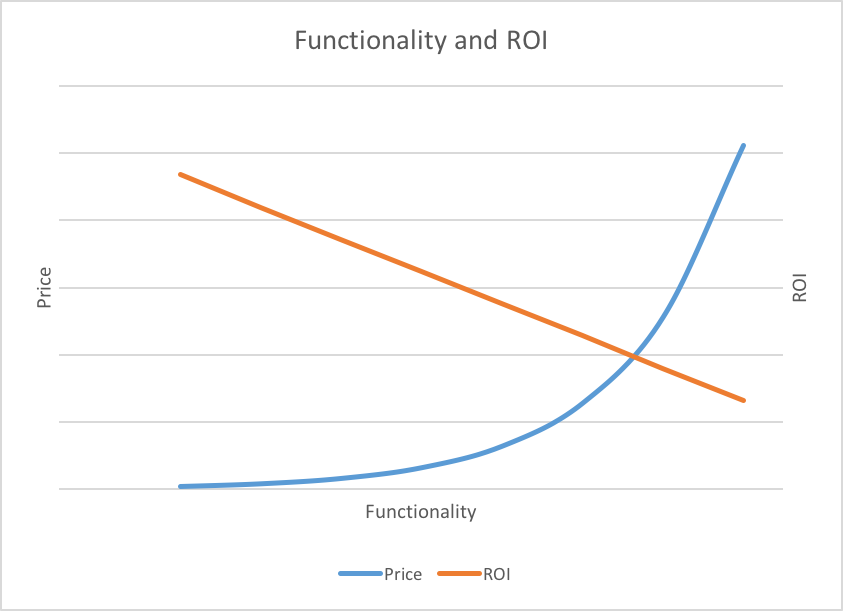

As the functionality spectrum expands in a linear manner costs expand logarithmically. That last 10% of functionality costs you another 70% in operating and setup cost. See chart below:

The growth of deployment in TMS software has been in the SMB (small to medium sized business) market. Companies with even modest transportation spends can benefit from automating their logistics processes and getting better reporting. Automation of for instance RFQs and simple carrier selection is a basic need to navigate the unruly nature of transportation sourcing. Even some large enterprises find themselves managing their transportation sourcing with spreadsheets and email. That is not an effective use of personnel resources. Beyond that it is error prone and prone to lack of effort in some cases.

Many shippers are revisiting the use of 3rd Party Logistics Providers (3PLs) to manage their transportation. Shippers are surprised in many case the amount of margin 3PLs charge for their services. Initially believing the average margin is somewhere in the 7%-8% range, it turns out that with some special deals here and there margins are more likely in the 13+% range. The software engaged by a 3PL to manage logistics is now available at an affordable price and is being effectively deployed by many shippers. Motor carriers would gladly work directly with shippers and more and more pricing is shipper specific as opposed to blanket discounts given only to 3PLs.

Mid-range TMS products define themselves as customizable logistics software that can be integrated into existing software such as an ERP, WMS or OMS. They offer advanced functionality only slightly below the level of very expensive systems such as BlueJay (formerly Kewill and LeanLogistics) or SAP and Oracle. Generally, these mid-range systems benefit from very intuitive and easy to use user interfaces and newer software which makes it far easier to create new code for specific applications.

What is different about mid-range transportation management systems is they don’t have the cost structure of legacy TMS providers. Most are SaaS and cloud hosted and thus can be implemented and maintained for significantly less initial setup and ongoing cost, sometimes as much as 75% less. This new thinking puts the power of a highly functional TMS into the hands of the small to mid-sized business market.

Visibility means information and information is power. Companies report the ability to clearly see what is going on in their supply chain and the time savings delivered by a TMS enable them to hone their inventory, improve sourcing and deliver significant savings in all aspects of the supply chain. What about visibility for your customers? Do you want tracking emails to be sent notifying your customers of an enroute shipment and providing a hyperlink for that tracking? With the strong penetration of online marketing, customers are now expecting ease of tracking. An alternative is to power a tracking routine on your website.

All freight rates are not created equal. Transportation charges vary vendor to vendor. Twenty percent variances are not uncommon, especially among LTL carriers. Choosing the right provider is imperative. Clumsily logging in to multiple carrier websites to make comparisons, seemed like advanced technology just a few years ago, today it looks like sticky notes and yellow pads compared to modern API technology retrieving and storing all rate quotes in one place at the click of a button. LTL sourcing management is all about API integration with carrier servers. Czar-Lite (master tariff) is a relic of the regulatory days and is being replaced by carrier’s own tariffs which more closely reflect that specific carrier’s needs and freight flow patterns. With modern mid-market TMS software, rate comparisons are populated in a few seconds, are up to date and accurate. Mid-tier TMS products should have this technology.

Adherence to low cost provider selection should be monitored against deviations. Reason codes can be established to ensure consideration in deviating. Those deviations should also note the cost change and variance reporting evaluated by management. Some mid-tier TMS products provide this variance reporting as valuable tool in controlling freight costs.

Truckload sourcing is a matter of rate and availability. If you have established rates with your truckload providers, most mid-market TMS platforms can execute waterfall or sequential tendering. No longer do you have to manually compute a rate to determine low cost provider and then ask them via email or phone if they have an available truck. A capable TMS can automate that function for you. Capacity is typically augmented by the use of freight brokers bringing spot market capacity to the market. A spot market quote gathering and tendering process should be in your TMS to take advantage of sometimes less expensive and sometime critically needed capacity. Having all of your spot market quotes in one place, organized and stored is vital to the health of your supply chain.

Availability is a big part of managing truckload shipping. Sequential, sometimes called waterfall tendering is a basic strategy to lower truckload shipping costs. In sequential tendering a load is offered to the lowest cost provider first and then after a user selected waiting time is then offered to higher costs carriers in a linear fashion. This tendering is typically subject to business rules to assure contract compliance and possible diversity requirements. This proven method saves hours of personnel time and assureds the lowest available cost carrier is being used on any given load. Waterfall tendering is in most mid-tier TMS products.

Automated tendering can be setup based on business rules. For instance, your sequence might be transit time first, cost second based on a promised by date entered in the order entry sequence of a sale. In some systems, both selected provider and lowest cost provider costs are logged. Logging enables a variance report to be generated letting you have quantifiable data to analyze the cost of perhaps production delays not allowing you to use the lowest cost carrier.

The ability to prepare and optimize consolidations is another consideration for many shippers. There are many levels of optimization with some optimizers costing near seven figures by themselves. Mid-range TMS products should offer optimization and consolidation. They should provide a visualization tool and the ability to provide custom prorating for cost tracking. In some cases, consolidations should be costed against LTL so accurate cost changes can be evaluated.

Since APIs or in some cases EDI is talking to the carrier’s server directly, transit problems and freight charge changes can be easily spotted letting the shippers get ahead of a problem before it gets worse. Reports are available on variances. Want to see delivery on time percentages by carrier? A few clicks of a button or on a dashboard you’ll have the data in real time. Which carriers are being more aggressive in reweighs resulting in higher freight charges, the answer is no longer subjective because you’re dealing with actual data without having to keep a log.

Auditing is the final step in a shipment other than historical analysis. Many firms hire outside freight payment service providers and some also include auditing functions. A mid-tier TMS would likely have an auditing function that flags exceptions and passes non-excepted transactions through to an accounting system. In most cases, auditing of exceptions is a review of the quoted rate and then a review of causation of the exception. If the fact series lines up with the cause of the exception the invoice reenters the payable cycle. A byproduct of auditing is the ability to create an accurate freight accrual. Since by auditing the receipt of a freight invoice is acknowledge, a TMS then knows the freight costs remaining outstand at the end of a process. The resultant report can be presented to accounting for a timely close of the periodic books.

What is the cost of mid-range TMS power? Depending on customization needs a basic integration is typically in the low to mid five figures and monthly costs around $2.00 per transaction or less depending on volume. The ROI on a mid-range TMS can sometimes be in the first month. Most people factor a 7-8% drop in freight spend and a larger drop in personnel resources. Those numbers do not assume the benefits of providing a better ability to negotiate and source transportation service providers. See pricing at www.shippersedge.com

Deployment of SaaS TMS solutions has changed radically in the past ten years. Integrations and development could typically take a year or more in 2007. Today, implantation and integration times are being reduced to, in some cases as little as a month. Open databases, structured processes and best practices have been maturing enabling the best in class TMS deployment to be quickly adapted to shippers with more modest freight spends. Training on today’s advanced mid-tier TMS systems is easier because with limited budgets, these TMS products had to be easy to use or training costs would exceed the cost of the product. Intuitive user interfaces that follow a logical path to task completion are the norm today as opposed to complicated layouts of yesteryear. They’re developed that way because they had to.

Reporting flexibility is also a given. Having to have custom reports built by programmers is an expensive solution to an ever-changing requirement. Criteria selection and field exporting is typically sent to an Excel spreadsheet where it can be easily massage and manipulated. Most systems will also have a dashboard, maybe customized for basic key point indicators (KPIs).

What’s missing? Probably nothing that small and mid-sized businesses need. The complicated screens that remind you of a spreadsheet on crack cocaine will be gone. Training is simpler as these systems are not overbuilt and since they’re sold to the SMB market, with a smaller setup budget, they had to be made easy to use. Truth is the legacy systems tend to keep their products unusually complicated to maintain a perverted justification in their pricing. Think of it as an airliner in the sixties with so many round dials it took three people to fly it, to a modern airliner with glass cockpits a teenager could learn to fly.

The case to management couldn’t be clearer. Modern technology reduces costs, provides better visibility and streamlines processes. A mid-market transportation management system provides the biggest bang for the buck.

tim-taylor

Latest posts by tim-taylor (see all)

- You Must Have Technology to Combat the Coming ELD Capacity Crisis - August 30, 2017

- The Value of Mid-Market Transportation Management Systems - July 21, 2017